The European Commission, headquartered in Brussels, Belgium, confirmed on Wednesday that it will impose a temporary import tariff of up to 38.1% on Chinese electric vehicle manufacturers.

In a statement, the EU said it would impose a 38.1% tariff on Chinese electric vehicle manufacturers who do not cooperate with the investigation, while Asian car manufacturers who cooperate with the investigation but are not "sampled" will be subject to a lower tariff of 21%.

Among them, SAIC Motor Corporation, which owns the British MG brand, will be subject to an additional 38.1% tariff, while Geely Holding Group, which holds Volvo and Polestar, will be subject to a 20% tariff, and BYD Auto will be subject to a 17.4% tariff. Chinese electric vehicle manufacturers who cooperate with the European Commission's investigation but are not sampled will be subject to a weighted average tariff of 21%, while those who do not cooperate will face a tax rate of 38.1%. The temporary tariffs will take effect on July 4, and the anti-subsidy investigation will continue until November, when final tariffs (usually for five years) may be applied. EU Trade Commissioner Valdis Dombrovskis told the media that these tariffs are related to the degree of cooperation of these companies with the investigation and the amount of information they provide.

Brussels' decision to impose different tariff rates on different car companies this time seems to imply a division among Chinese electric vehicle enterprises, while also considering trade protection for Western car manufacturers that produce and export to the EU in China.

The Brussels Commission, led by Ursula von der Leyen, has been following the US policy since last year, promoting an anti-competitive subsidy investigation against Chinese car manufacturers BYD, Geely, and SAIC. Recently, German Chancellor Olaf Scholz and French President Emmanuel Macron both suffered a crushing defeat in the European elections on Sunday. According to reports from Reuters in the UK and Politico in the US, the preliminary results of the 10th European Parliament elections announced on the 10th seem to show that the former chairman of Brussels, Ursula von der Leyen, is likely to be re-elected for the next five years.

However, Norway has decided not to follow the EU in raising tariffs on Chinese electric vehicles.

According to Bloomberg, Norwegian Finance Minister Trygve Slagsvold Vedum said that Norway, a leading country in electric vehicles, will not follow Brussels' resolution to join in raising tariffs on Chinese electric vehicles, "Tariffs on Chinese cars are not desirable."

This decision also reflects Norway's independent trade policy stance.

As a non-EU member, Norway is the country with the highest proportion of electric vehicle sales in the world, with electric vehicles accounting for 24% of Norway's vehicle stock, and more than 80% of new car sales in 2022 were electric vehicles.

In addition, according to reports from Fortune and Politico, Brussels' decision has not been supported by all EU member states. Although France has expressed approval, the automotive giant Germany has always been wary of these tariffs from Brussels and has tried to downplay and reduce Brussels' plan to impose tariffs at the last minute. German Chancellor Olaf Scholz has also been lobbying hard to minimize the EU's tariffs on Chinese electric vehicles. The German industry has also expressed concern and disappointment, criticizing the EU Commission's trade protectionist decision and condemning its harmful economic consequences for the German automotive industry.

According to data from Schmidt Automotive Research, BMW, Audi, and Mercedes-Benz have sold 19.2 million cars in China in the past decade, accounting for 30% to 40% of the global sales of the two car manufacturers.

In addition, countries such as Sweden and Hungary also oppose Brussels' policy of imposing additional import tariffs on Chinese electric vehicles.

Although this tariff policy is aimed at Chinese electric vehicles, Western car manufacturers that produce and ship to the EU in China, including Tesla, BMW, and Renault, also face higher costs. Tesla has also been pressuring Brussels recently to impose lower tariffs on it, as some of the electric vehicles from its Shanghai factory are exported to Europe.

European and American think tanks seem to have played a role in promoting the policy-making of the Brussels Commission. According to Fortune, the Rhodium Group, a New York-based organization specializing in Chinese activities, believes that the profitability of Chinese electric vehicles in Europe means that only tariffs exceeding 50% can weaken China's shipments to the EU. Although the company's research data shows that the value of European imported electric vehicles has soared from $1.6 billion in 2020 to $11.5 billion last year, most of the imported cars come from Western car manufacturers with factories in China, including Tesla and BMW.

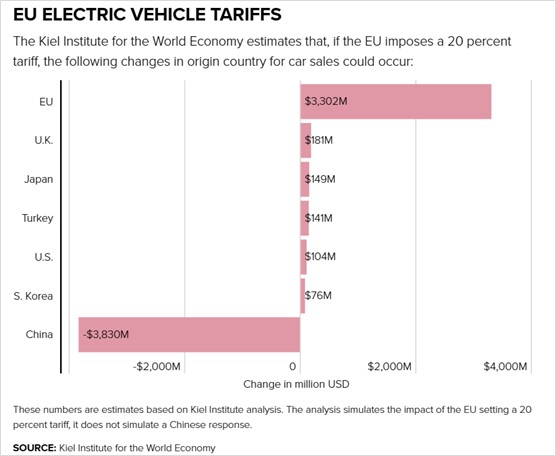

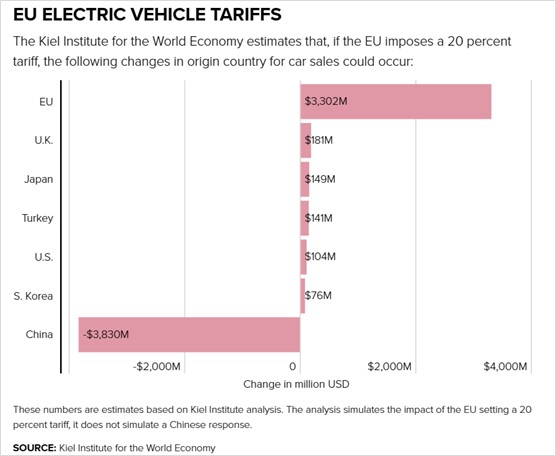

The Kiel Institute, a think tank based in Germany, optimistically predicted in a study released in May that a 25% tariff on Chinese electric vehicles would reduce imports by a quarter and believed that imposing tariffs on Chinese electric vehicles, although it would "reduce the number of electric vehicles in Europe," according to the research institution, "European car manufacturers may be the biggest beneficiaries, followed by British car manufacturers."

In addition, Politico reported that Elvire Fabry, a senior researcher at the Jacques Delors Institute in Paris, said, "A tariff rate of about 20-30% on (Chinese electric vehicles) will give European manufacturers some breathing space to accelerate their investment in the industry and maintain their market share in Europe."

The Atlantic Council, an American think tank, published a series of views from think tank researchers on this tariff policy, among which Sarah Bauerle Danzman believes, "The scale of these tariffs indicates that, at least for now, France's influence in EU trade policy is greater than that of Germany. Compared with German car brands, French car manufacturers are less dependent on the Chinese market and are more willing to use tariff policies to protect local production capacity. In fact, the tariffs and their political impact reflect the divide between EU member states closely related to the Chinese automotive industry (such as Germany, Sweden, and Hungary) and those who see China as a threat rather than an opportunity (such as France and Italy)."

"Germany, Sweden, and Hungary are against imposing tariffs... France, Italy, and several other EU countries advocate for additional tariffs... Due to the lack of internal consensus, as well as the rapid changes in the field of electric vehicles, the EU is likely to reconsider its decision in the coming months. The EU's decision is reserved in several aspects, and if the transatlantic alliance weakens next year, the EU may re-evaluate this decision," said Joseph Webster, a researcher at the Atlantic Council's Global Energy Center, who is responsible for researching Chinese energy.

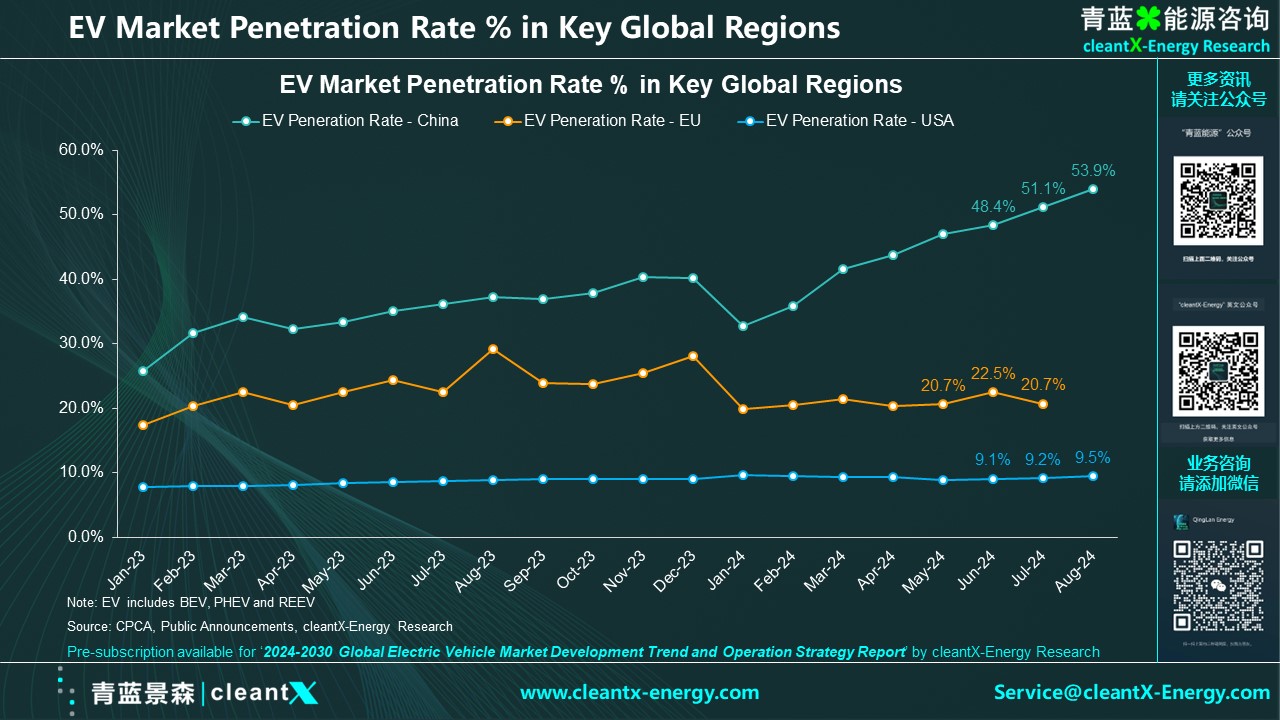

The Biden administration will increase tariffs on Chinese electric vehicles from the current 25% to 100%. US tariffs have almost stopped all imports of Chinese electric vehicles. The US electric vehicle market is slowing down, and according to recent market forecasts, the US electric vehicle market share this year may drop from the initial forecast of 10% to 8%, further slowing down the US transition to electric vehicles and carbon emission reduction. The EU also plans to achieve a 55% reduction in greenhouse gas emissions by 2030, but the EU is also experiencing a slowdown in electric vehicle sales. According to the "Long-Term Electric Vehicle Outlook" report released by BloombergNEF on June 12, the EU's electric vehicle sales forecast for 2026 has been revised down to 6.7 million.

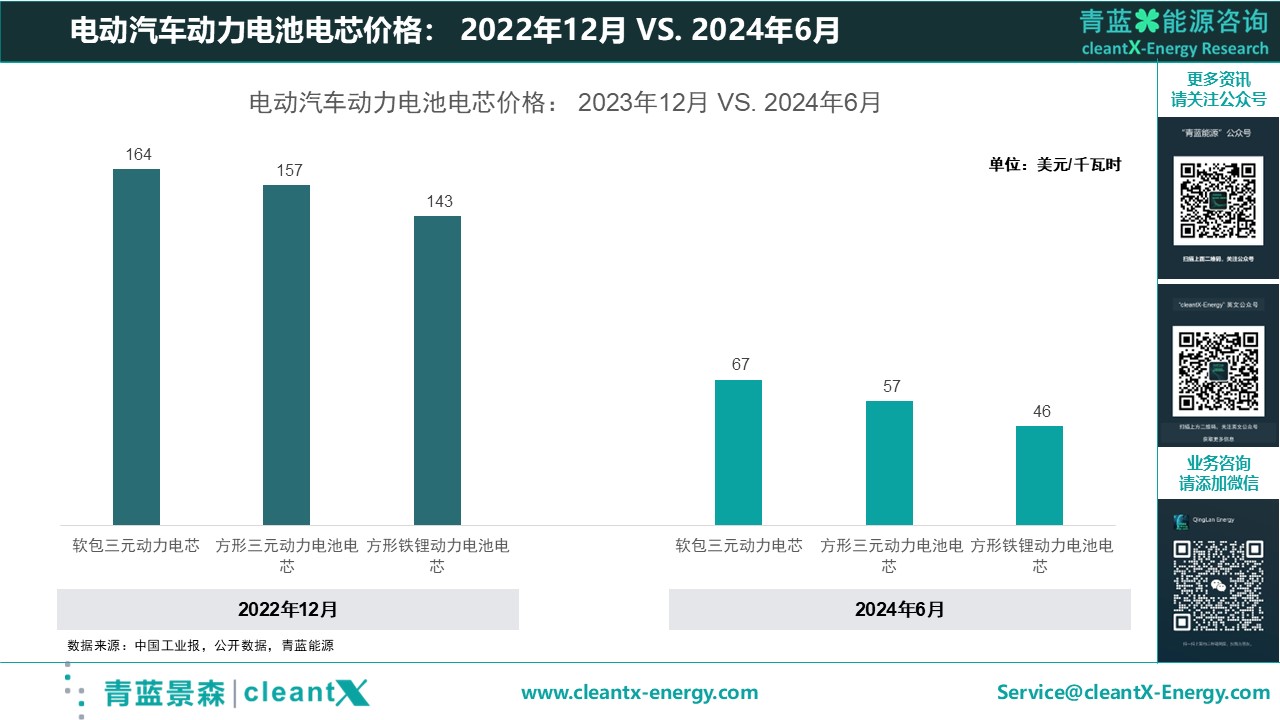

The lack of affordable mass-market electric vehicles is a common problem faced by the European and American markets, while Chinese electric vehicles are known for their good quality and low prices.

According to the report by BloombergNEF, China will continue to lead in electric vehicles, batteries, and the global raw material and parts supply chain.