Recently, multiple media including Reuters and Bloomberg have reported that General Motors is in discussions to acquire battery technology from China's CATL for the construction of a battery plant in the United States, facilitated by the Japanese company TDK.

According to sources familiar with the matter, the factory would be funded and operated by TDK, a Japanese corporation specializing in components for consumer electronics. Under the terms of the deal, TDK would receive a technology license from CATL to manufacture lithium iron phosphate (LFP) batteries, mirroring the LRS (License Royalty Service) collaboration mode currently in place between CATL and major automotive manufactures such as Ford and Tesla. In such cooperation mode, CATL would be responsible for establishing battery production lines, developing supply chains, commissioning production equipment, and managing manufacturing processes, while the automotive company part would cover the capital expenditure of the factory. CATL would not hold a stake in the battery production facility but would collect patent licensing and service fees.

But GM may differ from the partnerships Ford and Tesla have with CATL, as GM is not planning to take an equity stake in the venture, which could help avoid potential scrutiny or backlash from U.S. lawmakers and the Biden administration.

In February 2023, Ford announced a similar LRS collaboration with CATL, intending to build a wholly-owned LFP battery plant in Michigan. This partnership was significantly criticized by some U.S. legislators.

The battery plant in negotiation is expected to be located in the southern United States and could create over 1,000 jobs. If the collaboration with GM materializes smoothly, the factory might commence operations around 2027, following the planned opening of Ford's LFP battery plant in 2026.

Ultium Cells Warren, Ohio opened in 2022

GM's potential deal includes a supply contract term that would allow GM to purchase LFP cells from the TDK plant at a fixed price over a long-term contract. This structure would not only save billions in upfront costs but also shield GM from the volatility of battery price fluctuations.

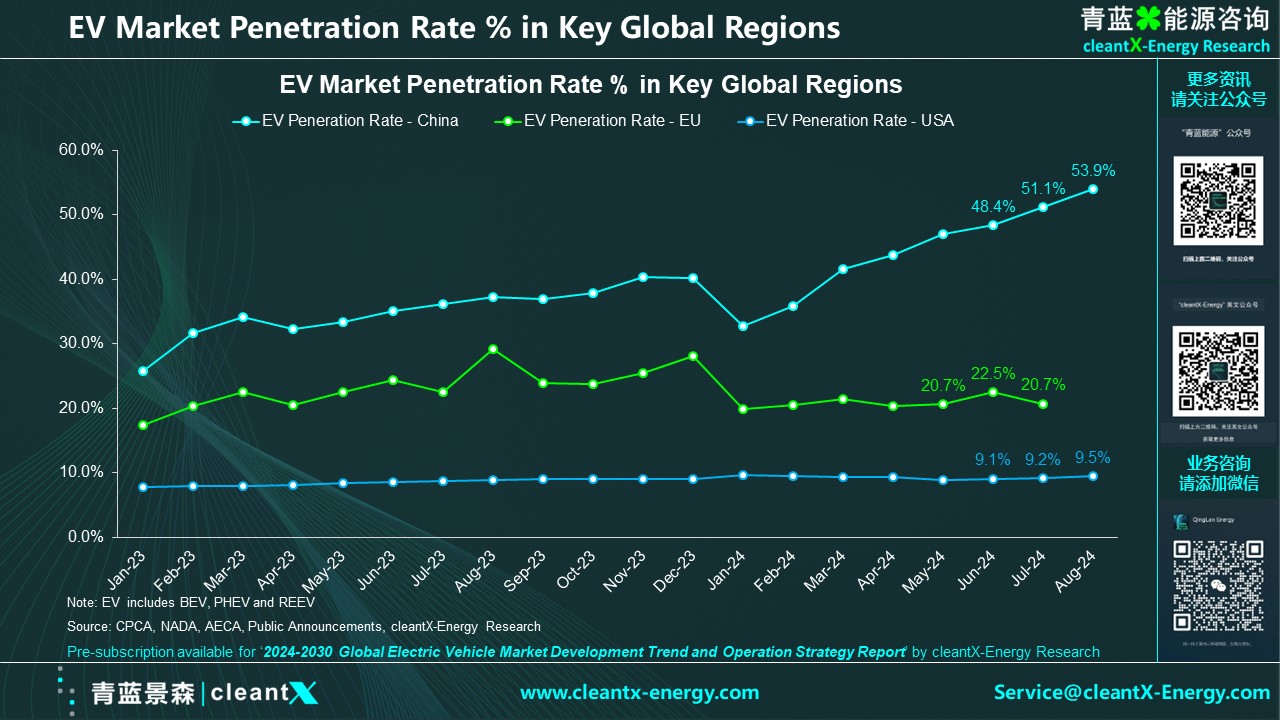

The U.S. has seen a slower adoption rate of electric vehicles compared to Europe and China, yet it holds substantial market potential. The EV market penetration in the U.S. was 5.9% in 2022, rising to 7.6% in 2023, with expectations to surpass 10% this year. Currently, the North American EV battery market is dominated by Japanese and Korean battery manufacturers, including LG Energy Solution, Samsung SDI, SK On, and Panasonic Energy, which control nearly 80% of the market share. However, the early neglect of LFP battery technology by these companies presents a significant opportunity for collaboration between Chinese and American industry manufacturers aiming to reduce costs through this technology.

If successfully implemented, this deal could significantly assist GM in securing lower-cost batteries and avoid additional tariffs by assembling them domestically in the United States.

Ongoing negotiations are influenced by various factors, including the outcome of the U.S. presidential election in November. Neither CATL nor GM have provided direct comments to the media. GM has stated that it will not comment on “speculation” and remains focused on its EV strategy, which emphasizes continued cost reduction, performance improvement, and localized production. On September 12th, GM just signed a Memorandum of Understanding with Hyundai Motors, where both parties will "leverage their complementary scale and strengths to reduce costs and bring a wider range of vehicles and technologies to customers faster."

U.S. policymakers are committed to promoting the domestic EV industry and establishing a local supply chain. They have implemented measures such as the Inflation Reduction Act (IRA) and Foreign Entity of Concern (FEOC) regulations to restrict the import of Chinese EVs and the use of batteries and components produced in China. While these measures aim to bolster the domestic industry, they also create challenges for American companies seeking to adopt advanced technologies for their energy transition.